Monetary Policy Of the UAE

Analysis

The Government of the UAE employs an active expansionary monetary policy that is dedicated to growing the economy and producing the desired economic goals of stable prices, low unemployment and high and sustained economic growth as evidence by the ariicle provided "Dubai plots return to credit markets". Dubai is planning to sell more bonds in order to finance a more diverse economic strategy.

Summary

With more money "in hand", Dubai will move forward with plans to increase real GDP by increasing government spending on things such as infrastructure and investments in the aviation market. This is a strategy that is in lock-step with governments fiscal policy in order to achieve the three ecomomic goals. While the goal remains the same, the implications are more severe and potentially more disastrous. As with fiscal policy, we gain a better understanding of how this may or may not effect the three economic goals by dichotomizing the subject into Hands-on(active) monertary policy, or Hands-off(freemarket) monetary policy. Again, it is understood that the Hands-off monetary policy in essence means little or no government intervention which is ultimately a contradiction of monetary policy.

Implications

Economic growth

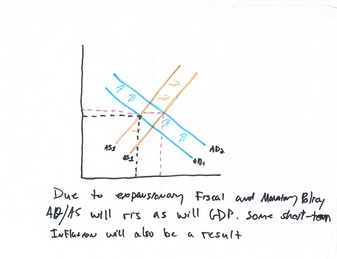

Buy selling bonds the UAE is stating implicitly that it believes that by aquiring the cash and issuing the bond to the purchaser at a certain interest rate, it can turn around and invest the cash into the channels it sees fit, whether this be infrastructure or aviation, and then payback the debt when the investment turns profitable. The plan faces many contingencies and hinders on the ability of the UAE to take full advantage by putting the cash to work in the most efficient way possible, and if history is any indicator Dubai's track record of risky bets is not a sure thing. Be that as it may, the results will undoubtedly be higher of GDP due to active Hands-on monetary policy.

A Hands-off monetary policy would, in essence, require that no debt be issued, rather sufficient cash to invest would have to be literally "in hand" before forward motion could begin on any project, regardless of how profitable the investment is deemed to be. This antiquated notion of "looking before you leap" seems to be falling further behind the times with every bond issued.

Low unemployment

In a Hands-off market economy, implementing monetary policy to achieve particular results, for example changing the money supply by selling more government issued bonds to achieve higher output of GDP, is considered bad money management and contrary to the idea of Hands-off economics. To simplify the perspective lets imagine the UAE is a small household family. Would it be sound policy for a house that is extended beyound thier means to engage in more borrowing in order to achieve a higher standard of living? Even if the goal is thought to be an increase of the households overall income, the risk of "mortgaging your future" could have unintended consenquences that are far reaching and generational.

The UAE could never be confused with a small household, with vast future wealth coming from a seemingless endless supply of oil. By using the Hands-on theory, Dubai will sell government issued bonds and use the cash to build roads and airports, putting it's citizens to work immediatly, effectively keeping unemployment low and GDP high.

Stable prices

Here, it seems, is where "the wheels fall off the wagon" when it comes to Hands-on monetary policy. To put in less contrived words, increasing the supply of money has been proven to increase overall prices and not just in the short term. It is foolish to think that monetary policy is the lone contributer to inflation, many factors must be weighed, but none seemingly have the same direct impact as monetary policy. The short-term gains are indeed popular for Hands-on monetary policy and the results are hard to argue with, but at what cost?

The point is conceded that many, many factors lead to inflation beyond monetary policy, whether expasionary or contractionary, and a Hands-off aproach would be fool-hearty in making the claim that inflation will never be a factor. But the point here is not zero inflation. No inflation would mean no increasing wage and no rising standard of living. The point is how to achieve the most prudent and effective forms of inflation, without increasing debt to unmanageable proportions.

Overview

The UAE had and has been proving to be successful in it's implementation of both fiscal policy and monetary policy. The heads of each state within the UAE are seemingly alligned in thier lazer-like focus of achieving the three economic goals and allowing the citizens to continue thier high standard of living that is on par with many western European nations.

The question remains of sustainability and willingness to adapt to an ever increasing globilized economy.

The Government of the UAE employs an active expansionary monetary policy that is dedicated to growing the economy and producing the desired economic goals of stable prices, low unemployment and high and sustained economic growth as evidence by the ariicle provided "Dubai plots return to credit markets". Dubai is planning to sell more bonds in order to finance a more diverse economic strategy.

Summary

With more money "in hand", Dubai will move forward with plans to increase real GDP by increasing government spending on things such as infrastructure and investments in the aviation market. This is a strategy that is in lock-step with governments fiscal policy in order to achieve the three ecomomic goals. While the goal remains the same, the implications are more severe and potentially more disastrous. As with fiscal policy, we gain a better understanding of how this may or may not effect the three economic goals by dichotomizing the subject into Hands-on(active) monertary policy, or Hands-off(freemarket) monetary policy. Again, it is understood that the Hands-off monetary policy in essence means little or no government intervention which is ultimately a contradiction of monetary policy.

Implications

Economic growth

Buy selling bonds the UAE is stating implicitly that it believes that by aquiring the cash and issuing the bond to the purchaser at a certain interest rate, it can turn around and invest the cash into the channels it sees fit, whether this be infrastructure or aviation, and then payback the debt when the investment turns profitable. The plan faces many contingencies and hinders on the ability of the UAE to take full advantage by putting the cash to work in the most efficient way possible, and if history is any indicator Dubai's track record of risky bets is not a sure thing. Be that as it may, the results will undoubtedly be higher of GDP due to active Hands-on monetary policy.

A Hands-off monetary policy would, in essence, require that no debt be issued, rather sufficient cash to invest would have to be literally "in hand" before forward motion could begin on any project, regardless of how profitable the investment is deemed to be. This antiquated notion of "looking before you leap" seems to be falling further behind the times with every bond issued.

Low unemployment

In a Hands-off market economy, implementing monetary policy to achieve particular results, for example changing the money supply by selling more government issued bonds to achieve higher output of GDP, is considered bad money management and contrary to the idea of Hands-off economics. To simplify the perspective lets imagine the UAE is a small household family. Would it be sound policy for a house that is extended beyound thier means to engage in more borrowing in order to achieve a higher standard of living? Even if the goal is thought to be an increase of the households overall income, the risk of "mortgaging your future" could have unintended consenquences that are far reaching and generational.

The UAE could never be confused with a small household, with vast future wealth coming from a seemingless endless supply of oil. By using the Hands-on theory, Dubai will sell government issued bonds and use the cash to build roads and airports, putting it's citizens to work immediatly, effectively keeping unemployment low and GDP high.

Stable prices

Here, it seems, is where "the wheels fall off the wagon" when it comes to Hands-on monetary policy. To put in less contrived words, increasing the supply of money has been proven to increase overall prices and not just in the short term. It is foolish to think that monetary policy is the lone contributer to inflation, many factors must be weighed, but none seemingly have the same direct impact as monetary policy. The short-term gains are indeed popular for Hands-on monetary policy and the results are hard to argue with, but at what cost?

The point is conceded that many, many factors lead to inflation beyond monetary policy, whether expasionary or contractionary, and a Hands-off aproach would be fool-hearty in making the claim that inflation will never be a factor. But the point here is not zero inflation. No inflation would mean no increasing wage and no rising standard of living. The point is how to achieve the most prudent and effective forms of inflation, without increasing debt to unmanageable proportions.

Overview

The UAE had and has been proving to be successful in it's implementation of both fiscal policy and monetary policy. The heads of each state within the UAE are seemingly alligned in thier lazer-like focus of achieving the three economic goals and allowing the citizens to continue thier high standard of living that is on par with many western European nations.

The question remains of sustainability and willingness to adapt to an ever increasing globilized economy.